Tax Information and Workshops

Information below is for tax year 2024. Income taxes must be filed by Tuesday, April 15, 2025.

An email containing a Sprintax federal tax code and tax workshop dates will be emailed to all current students and recent graduates in early 2024.

Virtually all F- or J- international students must file an income tax form every year in order to be in compliance with the Internal Revenue Service (IRS) regulations. It is very important to remain in compliance with U.S. tax regulations. Individuals in F-1 or J-1 status who receive a U.S. source of income that is subject to withholding must file by April 15, 2025. Records should be kept for five years. International students (with the exception of permanent residents, resident aliens for tax purposes, or those married to U.S. citizens) must file a 1040-NR Form for Non-Residents.

Non-residents with no 2024 income need only file one form via Sprintax (unless outside of the U.S. for all of 2024)

Need Sprintax Support?

If you need help while using Sprintax, you can contact their support team using the options below

You also have access to the Sprintax YouTube account where there are a number of educational videos on nonresident taxes. These will provide further clarity on nonresident tax and how to use Sprintax. Sprintax also offers a range of useful content on their blog to help you file your return.

DISCLAIMER: International Student Support (ISS) and Denison University are NOT permitted to assist any student/scholar with any IRS tax form preparation or tax-related questions. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.

An email containing a Sprintax federal tax code and tax workshop dates will be emailed to all current students and recent graduates in early 2024.

Virtually all F- or J- international students must file an income tax form every year in order to be in compliance with the Internal Revenue Service (IRS) regulations. It is very important to remain in compliance with U.S. tax regulations. Individuals in F-1 or J-1 status who receive a U.S. source of income that is subject to withholding must file by April 15, 2025. Records should be kept for five years. International students (with the exception of permanent residents, resident aliens for tax purposes, or those married to U.S. citizens) must file a 1040-NR Form for Non-Residents.

Non-residents with no 2024 income need only file one form via Sprintax (unless outside of the U.S. for all of 2024)

- Federal Form 8843 - determines residency for tax purposes

- Federal Form 8843 - determines residency for tax purposes

- Federal Form 1040NR

- State of Ohio IT 1040 EZ (can use Sprintax to file State of Ohio taxes at an additional fee or you can download the form from the State of Ohio's tax webpage and submit it by mail at no cost)

Virtual Tax workshops for international students will be held by Sprintax. Please use the links below to register for a tax workshop to complete your federal/state tax filing.

Sprintax Workshop Dates (Eastern Time Zone)

Sprintax Workshop Dates (Eastern Time Zone)

Wednesday, January 22nd @ 3pm

Thursday, February 6th @ 1pm

Tuesday, February 18th @ 12pm

Tuesday, March 4th @ 4pm

Wednesday, March 19th @ 2pm

Wednesday, March 26th @1pm

Thursday, April 3rd @ 3pm

Thursday, April 10th @ 12pm

Monday, April 14th @ 1pm

Thursday, February 6th @ 1pm

Tuesday, February 18th @ 12pm

Tuesday, March 4th @ 4pm

Wednesday, March 19th @ 2pm

Wednesday, March 26th @1pm

Thursday, April 3rd @ 3pm

Thursday, April 10th @ 12pm

Monday, April 14th @ 1pm

The informational general tax webinars will cover:

- An overview of tax for nonresident students and scholars

- Who must file a 2024 US tax return

- What income forms students/scholars may receive

- Forms that need to be completed and sent to the IRS

- We cover terms like FICA, ITIN and Form 1098-T

- What happens if students don’t file, or misfile

- State tax returns

- Sprintax overview – walk through the process, providing screen grabs of some of the steps that will need to be completed

Nonresident Alien – If you are not a U.S. Citizen, you are considered a nonresident alien unless you meet the Green Card Test or Substantial Presence Test. Students holding “F” or “J” visas will be considered nonresident aliens for tax purposes for the first 5 years in the U.S. If you meet one of these two tests, you may be considered a resident alien for tax purposes only.

Form W-2, Wage and Tax Statement, is used to report wages paid to employees and the taxes withheld from them. The form is also used to report FICA taxes to the Social Security Administration. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service.

Individuals who were employed on campus during calendar year 2024 receive a W-2 (statement of earnings) from Denison University. The Human Resources (HR) Office in Whisler generates the forms by the end of January each year. Students may elect to receive their W-2 electronically via Self Service. If you received a stipend from Denison, the relevant tax documents will be placed in your Slayter mailbox by the end of January. If you have questions about your 1042-S or your W-2, and your employer was Denison University, contact the Denison Payroll Office at payroll@denison.edu.

1040NR – The forms 1040NR and its “easy” version 1040NR-EZ are to be used by nonresident aliens filing a tax return. Nonresident aliens (eg F-1, J-1, etc. holders) who have been in the US for less than 5 years should use the 1040NR form.

1042-S - You may receive a 1042-S if you received wages that were exempt from federal and state tax withholding by a tax treaty and/or received a non-qualified taxable scholarship.

1099-INT – 1099 forms report various types of income other than wages, salaries, and tips. The 1099-INT form is used to report Interest Income from a Savings or Money Market bank account. You will receive this form by mail from your bank by February.

Form 8843: Special Filing for F-1, F-2, J-1 and J-2 Persons - Persons in F-1, F-2, J-1 or J-2 nonimmigrant status must file Form 8843 even if they received NO income in 2024. If you are required to file an income tax return, you should also include Form 8843 with your income tax filing. Form 8843 is not an income tax return; it is merely an informational statement required by the US government and sent to the IRS.

SSN - All individuals employed in the US should have an SSN. Learn how to obtain a Social Security Number.

ITIN - Requirements & How to Obtain an ITIN (for those who require a tax identification number, but who do not qualify for an SSN).

FICA withholding - Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance taxes, also known as Medicare taxes. If you are in F1 status and are considered a non-resident for tax purposes, you are generally exempt from these taxes. More information here.

Form W-2, Wage and Tax Statement, is used to report wages paid to employees and the taxes withheld from them. The form is also used to report FICA taxes to the Social Security Administration. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service.

Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation. The Form W-2 reports income on a calendar year (January 1 through December 31) basis. However, this refers to the time period in which an employee has been compensated, not necessarily the actual dates of employment. After the final payroll in December, employment is normally compensated and subject to tax in the following year.

Individuals who were employed on campus during calendar year 2024 receive a W-2 (statement of earnings) from Denison University. The Human Resources (HR) Office in Whisler generates the forms by the end of January each year. Students may elect to receive their W-2 electronically via Self Service. If you received a stipend from Denison, the relevant tax documents will be placed in your Slayter mailbox by the end of January. If you have questions about your 1042-S or your W-2, and your employer was Denison University, contact the Denison Payroll Office at payroll@denison.edu.

1040NR – The forms 1040NR and its “easy” version 1040NR-EZ are to be used by nonresident aliens filing a tax return. Nonresident aliens (eg F-1, J-1, etc. holders) who have been in the US for less than 5 years should use the 1040NR form.

1042-S - You may receive a 1042-S if you received wages that were exempt from federal and state tax withholding by a tax treaty and/or received a non-qualified taxable scholarship.

1099-INT – 1099 forms report various types of income other than wages, salaries, and tips. The 1099-INT form is used to report Interest Income from a Savings or Money Market bank account. You will receive this form by mail from your bank by February.

Form 8843: Special Filing for F-1, F-2, J-1 and J-2 Persons - Persons in F-1, F-2, J-1 or J-2 nonimmigrant status must file Form 8843 even if they received NO income in 2024. If you are required to file an income tax return, you should also include Form 8843 with your income tax filing. Form 8843 is not an income tax return; it is merely an informational statement required by the US government and sent to the IRS.

Form 8843 must be filed if an individual is:

- present in the U.S. during 2024

- a nonresident alien

- present in the U.S. under F-1, F-2, J-1, or J-2 status

* In general, you do not need to have a Social Security Number (SSN) or Individual Taypayer Identification Number (ITIN) in order to file Form 8843. However, if you have an ITIN or SSN you should put that number on the 8843.

SSN - All individuals employed in the US should have an SSN. Learn how to obtain a Social Security Number.

ITIN - Requirements & How to Obtain an ITIN (for those who require a tax identification number, but who do not qualify for an SSN).

FICA withholding - Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance taxes, also known as Medicare taxes. If you are in F1 status and are considered a non-resident for tax purposes, you are generally exempt from these taxes. More information here.

Who must file tax forms for 2024 tax season?

Even if you did not earn any income, if you were physically in the US in F or J status anytime between 1 January – 31 December 2024, you're obligated to file a Form 8843 with the IRS (the Internal Revenue Service, or ‘IRS’, are the US tax authorities).

Meanwhile, if you earned more than $0 of taxable US source income, you may need to file a federal tax return with the IRS. Depending on your individual circumstances, you may also need to file a state tax return(s).

Tax Filing Deadline:

April 15, 2025 is the last day for residents and nonresidents who earned US income to file Federal tax returns for the 2024 tax year.

Who is considered Resident or Nonresident for Federal Tax Purposes:

Generally, most international students & scholars who are on F, J, M or Q visas are considered nonresidents for tax purposes. International undergraduate students on J-1 & F-1 visas are automatically considered nonresident for their first five calendar years in the US, whilst Scholars/Researchers on J visas are automatically considered nonresidents for two out of the last six calendar years in the US. If you’ve been in the US for longer than the five or two year periods, the Substantial Presence Test will determine your tax residency.

How to File:

We have teamed up with Sprintax to provide you with an easy-to-use tax preparation software designed for nonresident students and scholars in the US. We (and all other university staff) are not qualified or allowed to provide individual tax advice.

After you login to Sprintax, you will be asked a series of questions about the time you have spent in the US over recent years. Sprintax will then determine your tax status. If it determines that you are a "nonresident alien" (NRA) for federal tax purposes, you can continue to use the software to respond to a series of guided questions. Sprintax will then complete and generate the tax forms you need for your federal tax return at no cost to you.

However, if Sprintax determines that you are a resident alien for federal tax purposes, you won't be able to continue using the software.

Step by Step guide on How to File Your Nonresident Tax Forms (F and J)

Even if you did not earn any income, if you were physically in the US in F or J status anytime between 1 January – 31 December 2024, you're obligated to file a Form 8843 with the IRS (the Internal Revenue Service, or ‘IRS’, are the US tax authorities).

Meanwhile, if you earned more than $0 of taxable US source income, you may need to file a federal tax return with the IRS. Depending on your individual circumstances, you may also need to file a state tax return(s).

Tax Filing Deadline:

April 15, 2025 is the last day for residents and nonresidents who earned US income to file Federal tax returns for the 2024 tax year.

Who is considered Resident or Nonresident for Federal Tax Purposes:

Generally, most international students & scholars who are on F, J, M or Q visas are considered nonresidents for tax purposes. International undergraduate students on J-1 & F-1 visas are automatically considered nonresident for their first five calendar years in the US, whilst Scholars/Researchers on J visas are automatically considered nonresidents for two out of the last six calendar years in the US. If you’ve been in the US for longer than the five or two year periods, the Substantial Presence Test will determine your tax residency.

How to File:

We have teamed up with Sprintax to provide you with an easy-to-use tax preparation software designed for nonresident students and scholars in the US. We (and all other university staff) are not qualified or allowed to provide individual tax advice.

After you login to Sprintax, you will be asked a series of questions about the time you have spent in the US over recent years. Sprintax will then determine your tax status. If it determines that you are a "nonresident alien" (NRA) for federal tax purposes, you can continue to use the software to respond to a series of guided questions. Sprintax will then complete and generate the tax forms you need for your federal tax return at no cost to you.

However, if Sprintax determines that you are a resident alien for federal tax purposes, you won't be able to continue using the software.

Step by Step guide on How to File Your Nonresident Tax Forms (F and J)

- Gather the documents you may need for Sprintax

- Passport

- Visa/Immigration information, including form I-20 (F status) or form DS-2019 (J status)

- Social Security or Individual Taxpayer Identification Number (if you have one) - This is not needed if you had no income and the 8843 is the only form you have to file.

- W-2 - This form reports your wage earnings if you worked. If you had more than one employer you should get a W-2 from each employer. It is issued by the end of January for the previous year. Make sure all employers from last year have an up-to-date address for you.

- 1042-S - If you received this type of income, the 1042-S will be mailed to you by 15 March by the payer.

Note: Only Nonresident Aliens receive this form. If your tax status changes to a Resident Alien you will not get a 1042-S. Login to Sprintax to check your tax status if you're not sure.

This form is used to report:- stipend, scholarship, fellowship income and travel grants (not tuition reduction or exemption)

- income covered by a tax treaty

- payment for other types of services (eg by the semester as a note-taker)

- US entry and exit dates for current and past visits to the US - In addition to passport stamps, you can review or print your US travel history here

- 1099 - This form reports miscellaneous income. Can be interest on bank accounts, stocks, bonds, dividends, earning through freelance employment

- 1098-T - This form is NOT needed and can NOT be used for a nonresident tax return because NRAs are not eligible to claim education expense tax credits.

- Create a Sprintax Account:

You will receive an email from the international student office providing you with a link to Sprintax to set up your account as well as your unique code to use on Sprintax. This unique code will cover the costs of the federal tax return and 8843 at no cost to you. Open your new Sprintax account by creating a UserID and password or if you have an existing account on Sprintax you can login using your existing credentials. - Follow the Sprintax instructions

If you did not earn any US Income: Sprintax will generate a completed Form 8843 for you and each of your dependents (if you have any).

If you did earn US Income: Sprintax will generate your "tax return documents", including the 1040NR.- If prompted for contact information for your program/school, please feel free to use details for ISS: Morayo Akinkugbe | akinkugbem@denison.edu | 100 W College St, Center for Global Programs | 740-587-6201

- If your forms are missing the "State Tax ID" for Denison University, note that the ID is 51151822

- Prepare a State Return, as needed:

After you finish your federal return, Sprintax will inform you if you need to complete a state tax return. If so, you will have the option to use Sprintax for an additional fee. However, it is your choice to use them or to complete the state tax return on your own.- Ohio state tax forms and publications are available at most public libraries and from tax.ohio.gov/Forms.aspx.

- If you wish to hire an accountant, the following online directories are available:

The Ohio Society of CPAs

National Association of Enrolled Agents

Ohio State Society of Enrolled Agents

*If you choose to hire an accountant, ask questions to determine if he/she understands international taxation and non-resident taxes. Be certain to ask about tax treaties, NRA exemption and deductions on tax returns. - The State of Ohio has provided a 2024 Income Tax Presentation that you may find useful. Webinars may also be available to answer frequently asked questions.

- If you have filed Ohio taxes previously, you may be eligible to file your return online; if not, you may need to print and mail your return.

- If you wish to hire an accountant, the following online directories are available:

- For links to the tax authorities of other states, visit the website of the Federation of Tax Administrators. Most states provide downloadable tax forms.

- Ohio state tax forms and publications are available at most public libraries and from tax.ohio.gov/Forms.aspx.

- Read the instructions for filing/mailing your federal returns or file online using the eFile option

Remember to read the instructions that Sprintax provides.

You will be required to download, print and sign your federal tax return and mail it to the IRS, or use the eFile option. If you use Sprintax to complete your state filing requirement, you must print and mail this to the tax authorities.

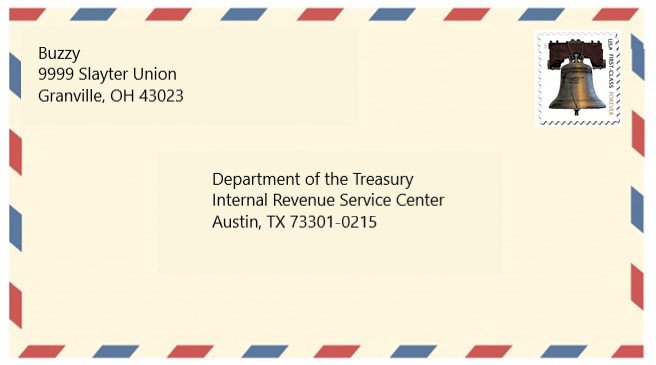

Finally, if you only need to file Form 8843, this will need to be mailed to the IRS.- To file the 8843, address the envelope like this:

Need Sprintax Support?

If you need help while using Sprintax, you can contact their support team using the options below

- Email - hello@sprintax.com

- 24/7 Live Chat Help

- Refer to their FAQs

You also have access to the Sprintax YouTube account where there are a number of educational videos on nonresident taxes. These will provide further clarity on nonresident tax and how to use Sprintax. Sprintax also offers a range of useful content on their blog to help you file your return.

DISCLAIMER: International Student Support (ISS) and Denison University are NOT permitted to assist any student/scholar with any IRS tax form preparation or tax-related questions. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.